Challenging efficiency targets are driving radical changes in the way that rail assets are managed. EC Harris report on Network Rail’s expenditure plans for the next five years

01/ Introduction

Investment in UK rail is increasing, providing a great opportunity for the UK supply chain to contribute to improving our ageing, congested network. Over the next five years, Network Rail has an ambitious investment programme, known as Control Period 5 (CP5), to meet stringent efficiency targets set by the Office for Rail Regulation (ORR).

Procurement and supply chain management are part of the solution for increasing efficiency. In anticipation of a rapid start to the investment programme, and given the critical need to secure capacity, some ÂŁ10bn of frameworks and alliances will have been procured in advance of CP5.

02/ Current market position

The performance of the UK’s railways is a constant source of national interest, with the industry expected to deliver more for less while the demand on rail infrastructure continues to expand. Network Rail has a crucial part to play in developing and maintaining the infrastructure to provide a “safe, reliable and efficient railway”.

The UK rail network, the oldest in the world, comprises 20,000 miles of track, runs 1 million more trains than a decade ago and is forecast to carry 1.62 billion passengers a year by 2019. Rail investment is the largest component of the National Infrastructure Plan, with some £9.4bn of investment identified in the Department for Transport’s High Level Output Specification (HLOS), and there are significant projects such as HS2 and Crossrail 2 planned to enhance capacity.

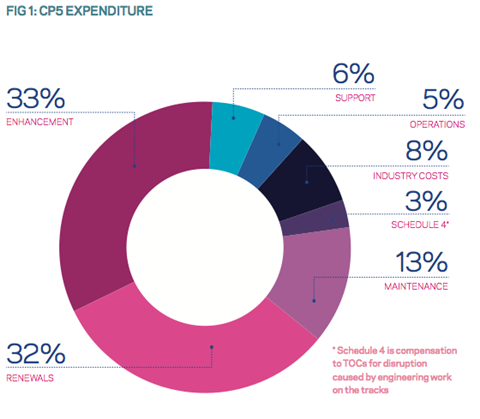

Total expenditure on rail infrastructure was ÂŁ11bn in 2012, covering operational and capital spending. Expenditure is funded through access charges from train operating companies (via passenger fares), government network grant (in lieu of access charges) and commercial activities, such as property and sales. With network grant having halved since 2006/7 and subsidy set at ÂŁ18bn for CP5 there is a real challenge to create a rail network that generates value for taxpayers and customers.

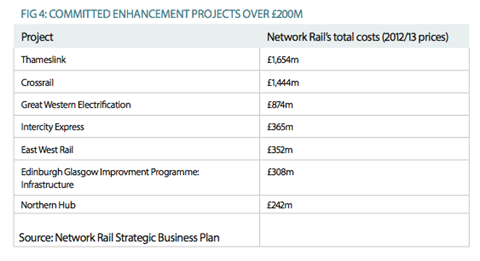

Overall expenditure for CP5 is ÂŁ38bn (Fig 1), ÂŁ500m higher than CP4. It is, however, ÂŁ1.8bn less than Network Rail calculated that it would need. Network Rail has been set a challenging target, and has until February to respond. The ORR recognises the challenge, backloading the efficiency gains towards the end of CP5 to enable catch-up. Anticipated savings vary across activity (Fig 2). Both Network Rail and the ORR have invested time and resources identifying and modelling where efficiencies could be achieved.

Some of the largest gaps between the ORR Final Determination and Network Rail’s plans are in support and operations, creating a significant management challenge. A substantial increase in efficiency will also be required in renewals, emphasising the role of asset management in focusing expenditure on priority work. Major investment and efficiency gains are to be delivered without compromise to performance targets around punctuality, disruption and passenger satisfaction.

03/ Stakeholders

Main stakeholders in the rail industry stretch across train operating companies (TOC), freight companies, rolling stock operating companies, passengers, as well as supply chain contractors, the regulator (the ORR) and the public body responsible for rail infrastructure, Network Rail. Passenger Transport Executives, the Rail Delivery Group, the Rail Safety and Standards Board and the Rail Accident Investigation Branch also play a role in the industry.

Network Rail

As the single body delivering the rail infrastructure, Network Rail is responsible for track, stations, civils, and fixed plant and signalling. It is responsible for 17 major stations, 20,000 miles of track and infrastructure, 32,000 bridges and more than 8,000 commercial properties.

Organisational change in the past 12 months focused on devolution, with 10 regional routes with regional teams now managing budgets and making local decisions. Corporate services, along with asset management policy and capital delivery functions, remain centralised.

Train operating companies

Devolution of Network Rail is being introduced hand in hand with changing relationships with TOCs, who run rail services through licences awarded via franchising arrangements (which have been extended to give TOCs greater incentive to invest in their network).

Framework alliance agreements provide a basis on which Network Rail and individual TOCs can determine the nature of their relationship, whether through longer term commercial links or creating partnerships for specific projects, all with the aim of improving the industry while keeping fares as low as possible. CP5 introduces joint outperformance incentives that allow savings on programme delivery to be retained and shared by Network Rail and TOCs.

Key performance measures for both Network Rail and TOCs have been around passenger satisfaction, punctuality and disruption to journeys. Delivering CP5’s renewal and enhancement programmes will continue to bring challenges around access, balancing journey time and punctuality objectives, with equally important renewal and enhancement targets. Programming works around track access and journey reliability requires shared objectives, effective planning and a safe and reliable approach to delivery.

Office for Rail Regulation

The ORR regulates Network Rail. It sets performance targets, determines expenditure for each five-year control periods and monitors progress against targets. Its priorities include driving down industry costs, customer satisfaction and health and safety. It views asset management and supply chain management as of key importance in the drive for continuous improvement. For the first time, regulatory targets relating to asset management will be introduced, with poor performance potentially leading to enforcement action.

04/ CP5: Meeting the efficiency challenge

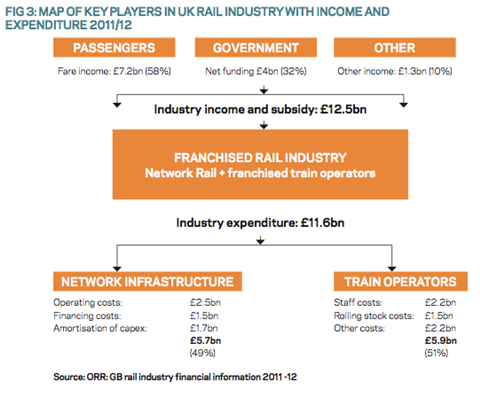

Renewal and enhancement work set out in Network Rail’s Strategic Business Plan for CP5 will deliver the largest network capacity increase in the UK for 100 years. In addition to delivering long-term programmes such as Thameslink and the Northern Hub (Fig 4), CP5 also involves a significant acceleration in the replacement of signalling (Fig 5). Backlog maintenance on the network’s bridge, tunnel and earthwork assets will also start to be addressed. The programme will deliver the Department for Transport’s HLOS, focusing on extending London’s rail network and enhancing the capacity, reliability and sustainability of the network through a series of major electrification projects outside London.

The challenge in CP5 should not be underestimated. Capital spend has grown, the network will be more crowded than ever and punctuality targets have increased. Furthermore, the focus of spend will switch to some of the busiest corridors in the country, including the Great Western Line, which will benefit from electrification as well as integration into Crossrail.

Network Rail’s response to these challenges has been to radically overhaul its procurement, supply chain and contracting strategy so that necessary new ways of working can be introduced.

While the Department of Transport’s Rail Value for Money Study identified plenty of scope for performance improvement, it did acknowledge that UK input costs, labour and materials are comparable to more efficient networks. The implication of this is that efficiency savings will come from doing less work and by changing work processes. Sources of efficiency include:

- Scope efficiency, or reducing the volume of work done through better work selection and more refined asset management. Much of this is embedded in new working practices introduced in CP4 - for example, maintenance carried out on the basis of performance risk assessment rather than fixed periods, which has been enabled through improved asset management data.

- Delivery efficiency, or reducing the cost of doing work, mainly by introducing more efficient working practices. Greater mechanisation of rail renewal is a good example, as this reduces the impact of works on rail traffic as well as reducing unit costs.

- Embedded efficiency. This refers to consequential improvements in ways of working as a result of other aspects of investment. For example, innovation in new electrification infrastructure will reduce maintenance costs compared with earlier programmes.

Specific areas where action can be taken to drive efficiency include:

- More efficient sch eduling of work, including giving the supply chain greater visibility of the workbank. In CP5, more renewal work will be done midweek - meaning that premium costs of weekend working will be reduced, and that the profile of work can be smoother.

- Increased productivity, which can be achieved through multi-skilling or through investment in plant, equipment and off-site manufacture. Higher productivity supports the effective scheduling of work - pre-assembled switches, for example, can be installed in a much shorter time window.

- Standardisation, which affects operation and maintenance as well as installation. A massive investment in re-signalling in CP5 is aimed at reducing levels of variation in systems and will result in substantial operational cost savings.

- Better management of possessions, including greater use of Adjacent Line Open (ALO) protocols, where work takes place next to a working railway. This will help to increase a contractor’s workbank and the effectiveness of work scheduling, but clearly has to be undertaken under a very carefully managed safety regime to protect both operatives and passing trains. Incentivisation in CP5 should encourage TOCs to collaborate on reducing possession costs.

- Reliability of handover and access management, minimising the impact of work on the operation of the railway and the risk of punctuality penalties for Network Rail.

- Reliability of plant and equipment, ensuring that scheduled work can be completed as planned.

- Delivery of the right work, at the right time, to a “right first time” standard. This involves a complex interplay between asset management for defining the work, site survey to plan what is required and the effective execution of the plan.

An effective procurement and supply chain strategy will be needed to put in place the collaborative behaviour needed for these more efficient ways of working. This has led Network Rail to adopt new project management, procurement and supply chain management strategies to encourage greater collaboration

and openness.

There will be incentive targets for enhancement projects, determined as project specification is confirmed. By March 2015, the ORR will be setting the efficiency costs at the aggregate level. Network Rail and its project partners will work together to get project scope and costs rights, and are encouraged to outperform. Savings can be shared, and overruns will also be shared between parties.